When you’re shopping for a product that costs hundreds of thousands of dollars, you’re going to want to make sure you get what you pay for. The province of BC has just strengthened consumer protections for homebuyers, effective January 3, 2023. Let’s guide you through the ins and outs of the program. But first.

Why now?

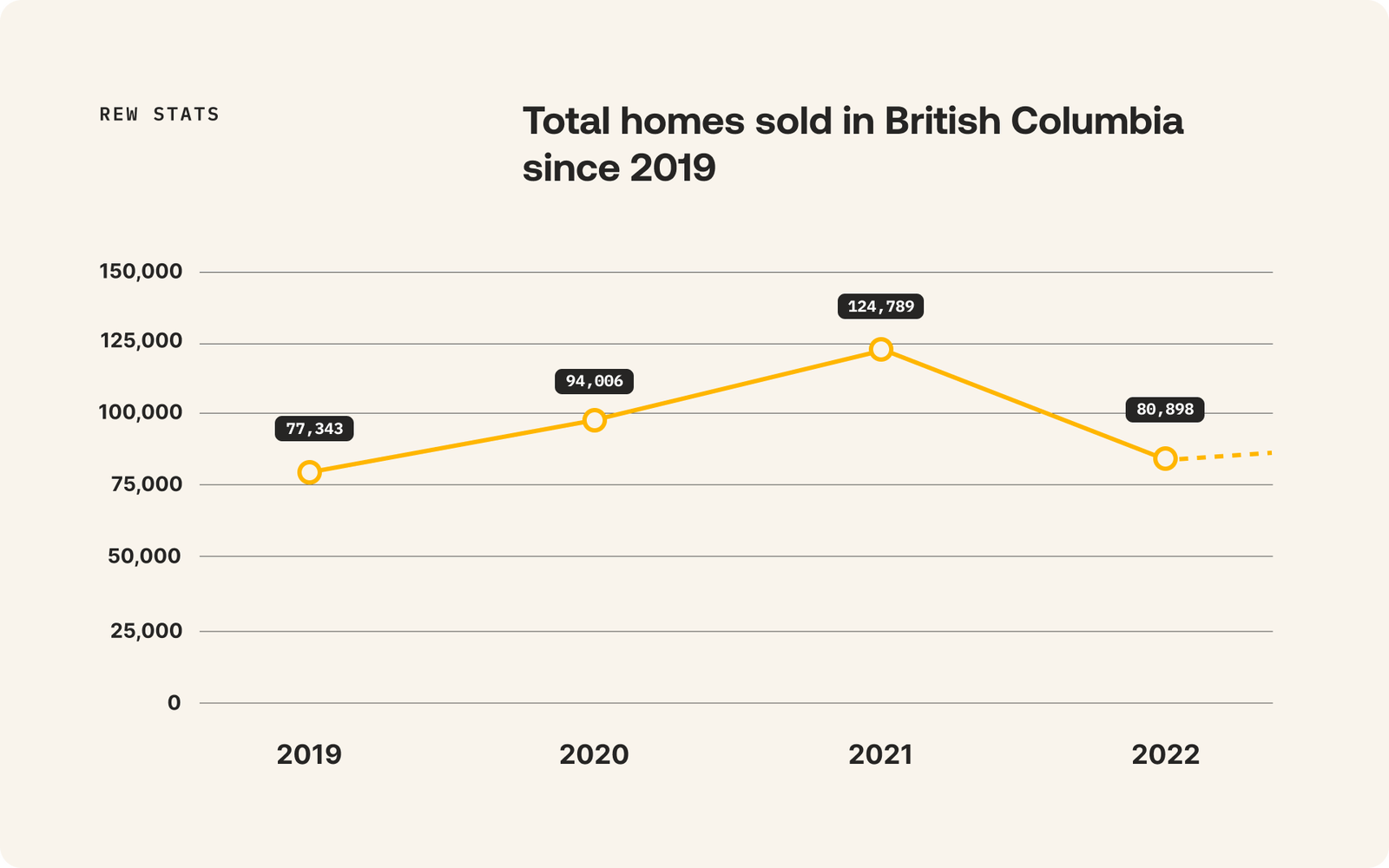

In The first-time homebuyers guide to the galaxy, we were pretty blunt: Don’t remove your subject to inspection unless you can afford a massive headache. Unfortunately, that advice isn’t always followed. Industry representatives estimate that more than 70% of offers in B.C.’s most competitive markets in 2021 may have been made without conditions. That’s a wildly high number that puts many homebuyers in a jam, leading to major repair and renovation costs, or even the loss of a deposit.

Buyers who opted to waive an inspection simply weren’t protected. And while no one forced buyers to remove their subject to inspection, market conditions pressured many into making the tough decision to forgo inspection in exchange for securing a home. The sheer number of people forgoing inspection led to the introduction of this amendment to the property act.

This isn’t a new idea.

Seven-day cooling-off periods for pre-construction sales of multi-unit development properties such as condominiums are already in place in BC, so the government isn’t reinventing the wheel here. This cooling-off period gives buyers an out. But as always, there’s a catch.

The catch.

And it’s a doozy. The rescission fee, or cancellation fee, should you decide to walk away from your purchase, is nothing to sneeze at. If you back out of a deal, you can expect to be on the hook for 0.25% of the purchase price, or $250 for every $100,000. A purchaser who exercises the right of rescission on a $1-million house would have to pay $2,500 to the seller. Here’s an explanation from Craig Veroni, a Vancouver-based real estate agent.

It might not change much…for now.

The days of multiple offers over asking without conditions might be behind us, but that doesn’t mean they won’t be back. Home sales dropped dramatically over the course of 2022, and buyers are feeling less pressure to remove subjects and win a bid against multiple offers. That said, this amendment could play a role the next time the market heats up, which in cities like Vancouver is never that far away.

Bottom line.

Work with a reputable agent that you trust so that you can avoid unnecessary fees and unexpected costs. Your best course of action is always going to be hiring someone who can guide you through the home-buying process and keep your interests in mind. Put together your A-Team, plan to add subjects to your offer that make the most sense for you and your family, and search with confidence. Having a great inspector, broker, notary and agent is the best way to ensure that you end up at the right destination. Don’t leave it to the government to protect you - that comes with a cost. Protect yourself at all times.

Original article from rew.ca